Dodgy aggregators

Pooling your funds

Gambling, adult, crypto, nutra in the EU/UK — if you’re too spicy for mainstream acquirers, CardCorp connects you to banks that say yes.

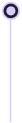

Honest feedback and a clear next step within 24 hours

High-risk doesn’t mean illegal. But mainstream acquirers don’t care — they’ll block you anyway. Then you may get…

Pooling your funds

That vanish overnight

That waste months of growth

We know the rules, the exceptions, and the workarounds that keep you live when others shut you down.

Your own MID, no pooled funds.

Banks that actually support your vertical.

MCC mapping, doc prep, compliance support.

We fight your case with acquirers.

Realistic thresholds and sustainable coverage.

Fast answers. If we’re the right fit, we’ll get you moving quickly.

If Stripe dumped you or PayPal blocked you, you’re in the right place. Every day we back high-risk merchants based in or targeting the EU and UK. Whether you’re licensed locally or offshore, we focus on coverage with European and UK acquirers who understand your vertical.

Sportsbooks, casinos, offshore operators.

Cam sites, clip stores, dating platforms.

Exchanges, ramps, wallets, licensed operators.

Supplements, continuity, upsells.

Tell us about your business and market.

We provide checklists and templates.

We connect you to banks ready to work with you.

We push your case through underwriting.

Start accepting payments with ongoing support.

Submit your details — we’ll guide you from review to approval.

It’s a merchant account for industries excluded by mainstream acquirers — gambling, adult, crypto, nutra, Forex, and more. With CardCorp, you get a direct MID, not an aggregator pool.

Because they’ll shut you down — sometimes without warning. They don’t support high-risk verticals. CardCorp works only with acquirers that specialise in your industry, so your coverage is built to last.

No. CardCorp focuses on acquirers in the EU and UK. If your business is registered or primarily operating outside these regions, we won’t be able to support you.

We review your case in 24 hours. If your docs are ready, many merchants are approved in just a few days. Complex cases may take longer — but we guide you through every step.

Yes. Unlike aggregators, you get a direct account with your own MID, payouts, and control over your funds.

Every high-risk merchant faces them. We place you with acquirers who set realistic thresholds and help you manage disputes — so you don’t get shut down after a single spike.

Yes. We follow scheme rules, work only with licensed acquirers, and help you structure your model in a way that regulators and banks will accept.

Gambling, adult, crypto/CASPs, nutraceuticals, subscriptions, Forex, and other edge ecommerce verticals. If mainstream acquirers reject you, we’ve got you.

No — and anyone who says otherwise is lying. But if we take you on, it’s because we’re confident we can get you approved and keep you live.

Tell us who you are. We’ll review and reply within a day. If we can help, we’ll get you back online 🚀